Comprehensive Guide to Form W-8BEN

Form Overview

Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting) is a tax certification document established by the Internal Revenue Service (IRS) for foreign individuals to certify their foreign status to U.S. withholding agents in order to claim tax treaty benefits or establish the correct withholding tax rate.

Legal Basis

This form is based on sections 1441 and 1442 of the U.S. Internal Revenue Code and related Treasury Regulations. It is an important component of the U.S. tax compliance system, ensuring that foreign persons’ tax obligations in the United States are properly executed.

Applicable Persons

Who Must Submit Form W-8BEN:

- Foreign individuals (non-U.S. tax residents)

- Recipients of passive income from U.S. sources

- Foreign individuals seeking to claim tax treaty benefits

- Individuals needing to establish foreign status to avoid backup withholding

Who Should NOT Use This Form:

- U.S. citizens or residents: Should use Form W-9

- Foreign entities: Should use Form W-8BEN-E

- Foreign governments: Should use Form W-8EXP

- Foreign tax-exempt organizations: Should use Form W-8EXP

Types of Income Covered

U.S. Source Income Requiring Form W-8BEN:

-

Dividend Income

- U.S. corporate stock dividends

- Mutual fund distributions

- Real Estate Investment Trust (REIT) distributions

-

Interest Income

- Bank deposit interest

- Bond interest

- Certificate of deposit interest

-

Royalty Income

- Intellectual property licensing fees

- Patent licensing fees

- Copyright royalties

-

Rental Income

- U.S. real estate rental income

- Equipment leasing fees

-

Other Fixed or Determinable Income

- Annuity payments

- Pension distributions

- Certain service fees

Detailed Form Instructions

Part I: Identification Information

- Line 1: Enter individual’s name (consistent with passport)

- Line 2: Enter country of residence

- Line 3: Enter permanent residence address

- Line 4: Enter mailing address (if different from residence)

- Line 5: Enter U.S. taxpayer identification number (if any)

Part II: Tax Treaty Claim

- Line 9: Enter treaty country

- Line 10: Enter treaty article and rate

- Line 11: Explain reason for treaty benefit entitlement

Part III: Signature and Date

- Must be signed personally by the beneficial owner

- Include signature date

- Indicate capacity (individual, trustee, etc.)

Tax Treaty Benefits

Common Treaty Rates:

- China: Dividends 10%, Interest 10%, Royalties 10%

- Canada: Dividends 5-15%, Interest 0%, Royalties 0-10%

- United Kingdom: Dividends 0-15%, Interest 0%, Royalties 0%

- Germany: Dividends 5-15%, Interest 0%, Royalties 0%

- Japan: Dividends 10%, Interest 10%, Royalties 0%

Conditions for Treaty Benefits:

- Must be a tax resident of the treaty country

- Must be the beneficial owner of the income

- Cannot be a conduit company or agent

- Must meet specific conditions in the treaty

Submission Timeline and Methods

Submission Timeline:

- Optimal timing: Before receiving first payment

- Deadline: Before income payment

- Update timing: Immediately when circumstances change

Submission Methods:

- Direct submission to withholding agent (banks, brokers, etc.)

- Electronic submission (if supported by withholding agent)

- Mail or fax to relevant institution

Validity Period and Updates

Validity Period:

- General validity: 3 years from signature date

- Special circumstances: Becomes invalid immediately when circumstances change

When Updates Are Required:

- Change in country of residence

- Name or address changes

- Change in tax status

- Change in beneficial owner status

Common Errors and Important Notes

Filing Errors:

- Name inconsistency: Doesn’t match passport or identification documents

- Address errors: Using mailing address instead of residence address

- Incorrect tax treaty information: Wrong article or rate

- Signature issues: Agent signature or improper signature

Compliance Risks:

- False information: May face civil and criminal penalties

- Failure to update timely: May lose treaty benefits

- Failure to submit form: May be subject to 30% backup withholding

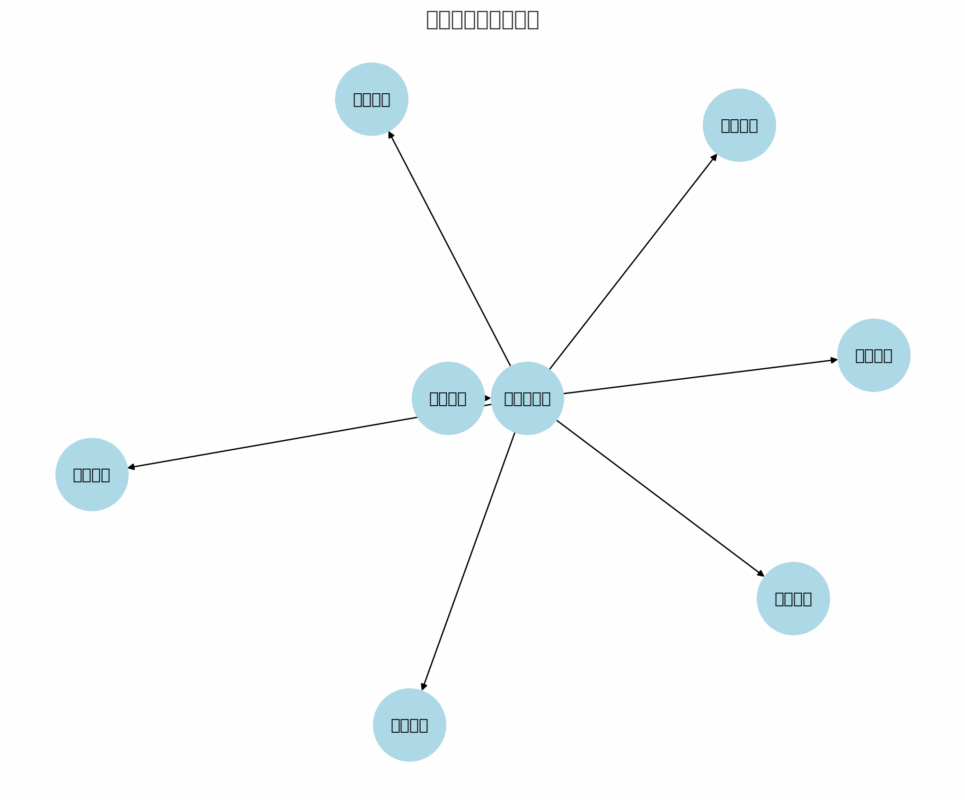

Relationship with Other Forms

W-8 Series Form Comparison:

- W-8BEN: Used by foreign individuals

- W-8BEN-E: Used by foreign entities

- W-8ECI: For income effectively connected with U.S. trade or business

- W-8EXP: Used by foreign governments and exempt organizations

- W-8IMY: Used by intermediaries

Differences from Form W-9:

- W-9: Used by U.S. persons

- W-8BEN: Used by foreign persons

- Information requirements: W-9 requires SSN, W-8BEN requires foreign tax ID

Practical Operation Recommendations

Preparation Materials:

- Valid passport or identification document

- Proof of residence documents

- Tax residence certification

- Relevant tax treaty text

Completion Tips:

- Complete in English

- Use clear handwriting, avoid alterations

- Consult tax professionals if uncertain

- Keep copies for records

Ongoing Management:

- Regularly check expiration dates

- Update changes promptly

- Maintain communication with withholding agents

- Monitor tax treaty changes

Related Legal References

- U.S. Internal Revenue Code Section 1441

- U.S. Internal Revenue Code Section 1442

- Treasury Regulation Section 1.1441-1

- Treasury Regulation Section 1.1441-6

- Relevant bilateral tax treaties

Conclusion

Form W-8BEN is an important tax tool for foreign individuals investing in or receiving income from the United States. Proper completion and timely submission of this form not only allows for tax treaty benefits but also helps avoid unnecessary tax risks. It is recommended to carefully read relevant guidance documents before completion and consult professional tax advisors when necessary.

中文 (简体)

中文 (简体)