Forms Required for Nonresident Aliens to File Taxes

As a Nonresident Alien, if you have income from the U.S. and need to file taxes, you may need to complete various tax forms. The forms required depend on the type of income, your tax status, and whether you are eligible for tax treaty benefits between the U.S. and your home country.

Here are the most commonly used tax forms for nonresident aliens, along with the situations in which they apply:

1. Form 1040-NR — U.S. Nonresident Alien Income Tax Return

When to Use: If you are a Nonresident Alien and have income from U.S. sources (such as wages, rental income, investment income, etc.), you need to file this form to report your U.S.-sourced income and calculate your tax liability.

2. Form W-7 — Application for IRS Individual Taxpayer Identification Number (ITIN)

When to Use: If you do not have a Social Security Number (SSN) but need to file taxes or handle U.S. tax matters, you must apply for an ITIN (Individual Taxpayer Identification Number).

3. Form 8843 — Statement for Exempt Individuals and Individuals With a Medical Condition

When to Use: If you are a student, scholar, or exchange visitor holding an F-1 or J-1 visa and are exempt from U.S. taxes, you need to file this form to declare your exempt status, even if you have no income.

4. Form W-8BEN — Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding

When to Use: If you are a Nonresident Alien and receive U.S.-sourced income (such as dividends, interest, or rent), you need to file this form to certify your foreign status and reduce or avoid U.S. tax withholding.

5. Form 8233 — Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual

When to Use: If you are a Nonresident Alien providing independent services (such as freelancing or contracting) and have tax treaty benefits, you can use this form to apply for an exemption from withholding tax.

Summary

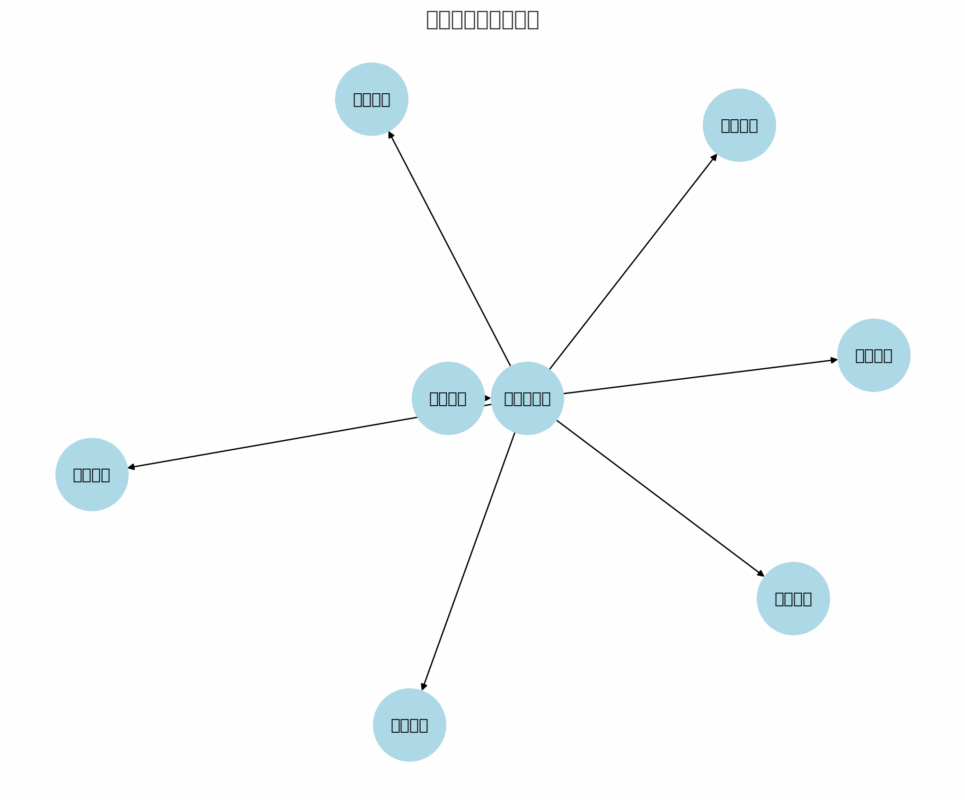

For Nonresident Aliens, the most commonly used forms for tax filing include:

- Form 1040-NR: Used to report U.S.-sourced income

- Form W-7: Used to apply for an ITIN when you do not have an SSN

- Form 8843: Used for tax-exempt status for students, scholars, etc.

- Form W-8BEN: Used to certify foreign status and reduce or avoid U.S. withholding tax

- Form 8233: Used by freelancers to apply for tax exemptions

Depending on your tax status and income sources, select the appropriate form to fill out and ensure compliance with U.S. tax requirements, avoiding double taxation or unnecessary tax issues. If you are unsure about which form to fill out or have questions, it is recommended to consult a professional tax advisor to ensure compliance.

中文 (简体)

中文 (简体)