Understanding IRS Form 8843: Statement for Exempt Individuals and Individuals With a Medical Condition

Form 8843 is a crucial informational statement required by the Internal Revenue Service (IRS) for certain non-U.S. citizens. It is not a tax return and does not involve reporting income. Its primary purpose is to support your claim that you are a “nonresident alien” for U.S. tax purposes and can therefore exclude your days of presence in the U.S. from being counted for the Substantial Presence Test.

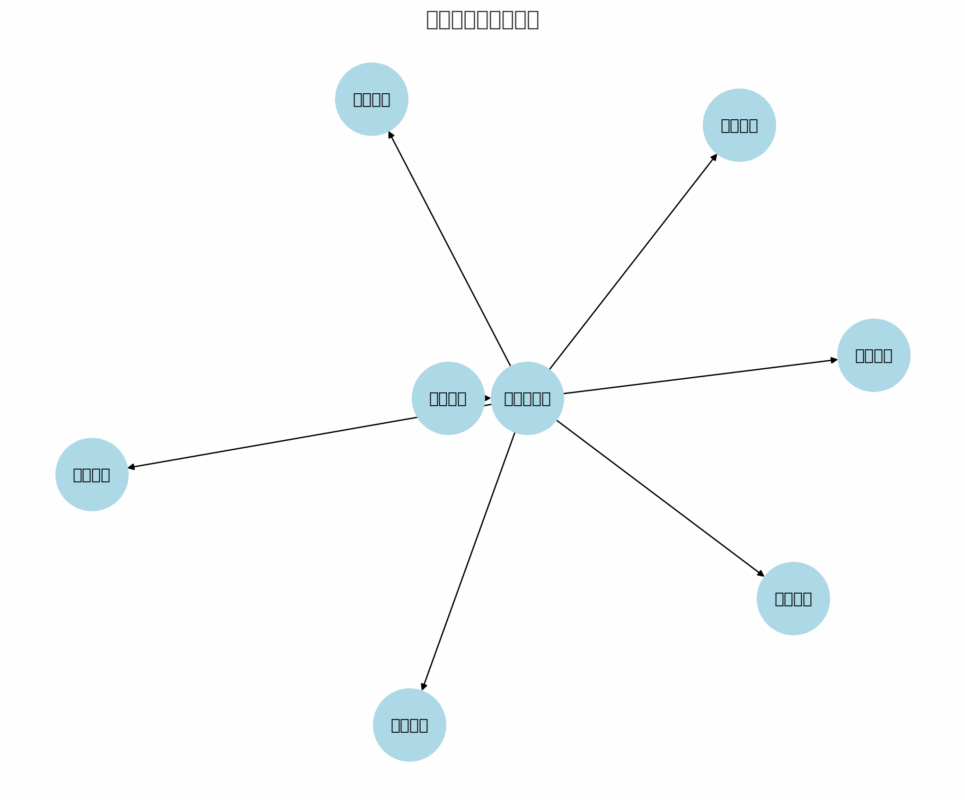

The Main Purpose: The Substantial Presence Test

The U.S. uses a “Substantial Presence Test” to determine if an individual should be taxed as a U.S. resident. If you are physically present in the U.S. for a certain number of days, you are generally considered a “resident alien for tax purposes,” meaning you are taxed on your worldwide income, just like a U.S. citizen.

However, certain “exempt individuals”—like students, teachers, and trainees on specific visas—can exclude their days of physical presence in the U.S. from this test. Form 8843 is the official statement you file to claim this exemption.

Who Must File Form 8843?

You must file Form 8843 if you are a nonresident alien present in the U.S. under one of the following visa types, even if you had no income from U.S. sources.

-

Students: Individuals on an

F,J,M, orQvisa. -

Teachers or Trainees: Individuals on a

JorQvisa. -

Professional Athletes: Individuals temporarily in the U.S. to compete in a charitable sports event.

-

Individuals with a Medical Condition: Individuals who planned to leave the U.S. but were unable to due to a medical condition that arose while they were here.

Crucially, every “exempt individual,” including their spouse and dependents who are also on derivative visas (e.g., F-2, J-2), must file their own separate Form 8843.

Important: Form 8843 is NOT a Tax Return

This is a common point of confusion.

-

Form 8843is an informational statement. -

Form 1040-NRis the U.S. Nonresident Alien Income Tax Return, used to report U.S. source income.

If you are an exempt individual who also has U.S. source income (e.g., a scholarship or wages from on-campus employment), you will likely need to file both Form 8843 and Form 1040-NR. Form 8843 should be attached to your tax return.

Filing Deadline (for the 2024 Tax Year)

The deadline for filing Form 8843 for the 2024 tax year has passed. The rules are generally as follows:

-

If you are also filing a

Form 1040-NR: The deadline was April 15, 2025. You should attachForm 8843to the back of your1040-NR. -

If you are NOT required to file a

Form 1040-NR(because you had no U.S. income): You must still fileForm 8843on its own. The deadline for this was June 16, 2025 (since June 15th was a Sunday).

If you have not yet filed a required Form 8843 for 2024 or a prior year, you should file it as soon as possible.

How to Complete Form 8843

The form is relatively straightforward:

-

Part I – General Information: All individuals must complete this part. It asks for your name, address, passport and visa information, and the number of days you were present in the U.S. during the last three years.

-

Part II – Teachers and Trainees: This part is only for individuals on a

JorQvisa. It asks for information about the institution sponsoring you. -

Part III – Students: This part is only for individuals on an

F,J,M, orQvisa. It asks for information about your school or academic institution.

Most individuals will only fill out Part I and either Part II or Part III, not both.

Where to Mail Form 8843

The mailing address depends on your situation:

-

If filing with a

Form 1040-NR: Mail both forms to the address listed in theForm 1040-NRinstructions. -

If filing

Form 8843by itself: Mail it to:Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

Always check the official IRS instructions for the most current address before mailing.

Why is Filing Form 8843 So Important?

Failure to file Form 8843 when required can have serious consequences. If you do not file it, the IRS may not consider you an “exempt individual.” This means your days of presence in the U.S. could be counted for the Substantial Presence Test. If you meet the test, you could be classified as a “resident alien for tax purposes,” making you liable for U.S. taxes on your worldwide income. Filing Form 8843 is a simple but critical step to maintain your proper tax status.

中文 (简体)

中文 (简体)